In July 2020, the EU’s Taxonomy Regulation entered into force. This is a classification system which establishes a list of environmentally sustainable economic activities: climate change mitigation/adaptation, transition to a circular economy etc. This created a legislative framework which would provide the market with necessary confidence on environmental performance and help investors and companies to plan and report on the transition.

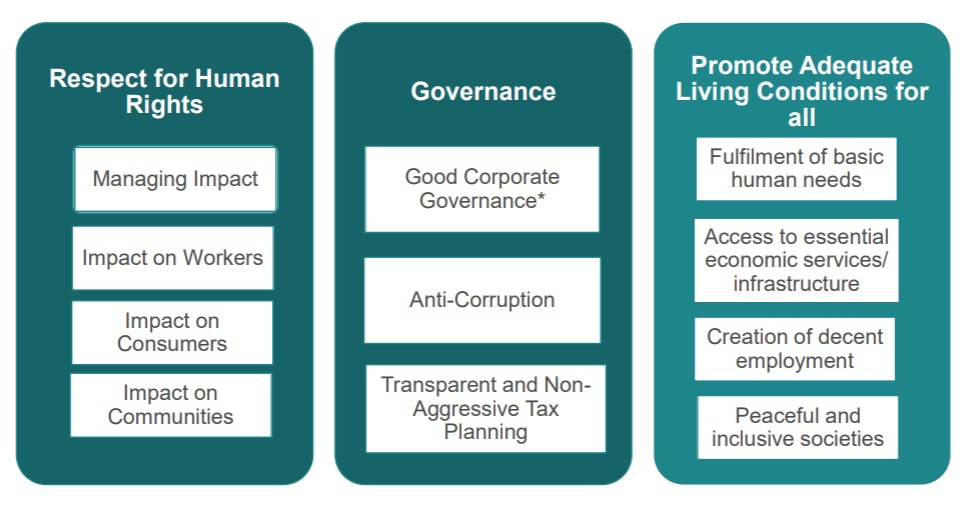

Linking this to social finance, a recent mandate was introduced to advise the EU Commision on possibly extending the structure towards more of a social taxonomy which would contribute towards social objectives, such as business ethics, governance, access to healthcare, equality/non-discrimination etc. This would allow these social objectives to be acknowledged as a key element of future sustainable investing – which aligns with the concept of social finance. The ideas for these objectives can be seen below:

Source: Webinar on social taxonomy – Platform on Sustainable Finance

In recent times, there is pressure for those investing to take into consideration social issues when choosing their investment, as a lack of consideration about these topics carries a special risk – which includes possible contribution to climate change/breaches of human rights laws, malpractice of board members and failure to comply with fiduciary duty in tackling social issues. The taxonomy regulations are a strong example about how theories such as social finance need framework and legislation in order to be successfully put into practice. If the EU taxonomy pivots to prioritize the aforementioned social objectives, this will create a great opportunity for social finance to grow its resources and be able to have more of an impact across the sector.